Towards Strengthening Indonesia-Namibia Economic Relations

Hacia el Fortalecimiento de las Relaciones Econ micas entre Indonesia y Namibia

Sulthon Sjahril Sabaruddin

Embassy of the Republic of Indonesia in Windhoek

Sulthon Sjahril is a Senior Career Diplomat (Counsellor) and currently assigned as the Head of Economic Division at the Indonesian Embassy in Windhoek (2020-2024). His diplomatic service experience includes: as a Charg d Affaires Indonesian Embassy in Sana a (2016-2018) and Indonesian Embassy Attach in Santiago (2010-2011). His recent assignments at the MoFA headquarter including: the Centre for Education and Training (2019-2020) and the Centre for Policy Analysis and Development in American and European Regions (2013-2016). He completed his PhD in International Economics from Universitas Indonesia in 2012, Master of Business Administration from Charles Sturt University (2005) and Bachelor of Commerce at the University of Wollongong, Australia (2003). He completed the Senior-Career Foreign Service Officer Course (2023) and did two postdoctoral programs: Postdoctoral Fellowship at the Namibia University of Science and Technology (2022-2024) and the Senior Fulbright Scholar scheme (Postdoctoral Program) at the Department of Economics, Pomona College and Claremont Graduate University, California (2014-2015). He also had the opportunity to become a Visiting Professor at Centro de Investigaci n y Docencia Econ micas (CIDE), Mexico (2015), and a Visiting Diplomatic Scholar at Instituto del Servicio Exterior de la Nacion, Buenos Aires (2012).

Abstract || This paper discusses current Indonesia-Namibia bilateral economic relations and explores opportunities and the way forward in elevating this existing relationship to a higher level. The study shows that the respective foreign policy agendas of these two nations coincide with their common interests particularly to enhance economic relations through economic diplomacy. Based on the product competitiveness mapping analysis, the study concludes that there are potential opportunities to strengthen bilateral trade relations due to the complementarity of both countries export products. The study also reveals the competitiveness of the two countries respective export products remains low. The partial equilibrium free trade simulation employed shows that both countries would potentially benefit from bilateral FTA arrangements. This is based on assumed higher trade volumes and consumer surpluses, which would offset predicted tariff revenue loss. The study also conducted the future scenario planning and trends analysis, in which the best scenario from the case is Scenario 3, where both countries should pursue Indonesia-SACU PTA as both parties would be better off based on the predicted economic potential benefits. Apart from trade, promoting Indonesian outbound investment and technical cooperation are another potential win-win economic cooperation for both countries.

Keywords || Comparative advantage, Product competitiveness, Preferential trade agreement, Economic diplomacy, Foreign policy analysis

Resumen || Este art culo discute las actuales relaciones econ micas bilaterales entre Indonesia y Namibia, y explora oportunidades y el camino a seguir para elevar esta relaci n existente a un nivel superior. El estudio muestra que las respectivas agendas de pol tica exterior de estas dos naciones coinciden con sus intereses comunes, particularmente para mejorar las relaciones econ micas a trav s de la diplomacia econ mica. Basado en el an lisis de mapeo de competitividad de productos, el estudio concluye que existen oportunidades potenciales para fortalecer las relaciones comerciales bilaterales debido a la complementariedad de los productos de exportaci n de ambos pa ses. El estudio tambi n revela que la competitividad de los productos de exportaci n respectivos de los dos pa ses sigue siendo baja. La simulaci n de libre comercio de equilibrio parcial empleada muestra que ambos pa ses podr an beneficiarse potencialmente de los acuerdos bilaterales de libre comercio (FTA). Esto se basa en los supuestos de mayores vol menes de comercio y excedentes del consumidor, que compensar an la p rdida prevista de ingresos por aranceles. El estudio tambi n realiz la planificaci n de escenarios futuros y el an lisis de tendencias, en el cual el mejor escenario del caso es el Escenario 3, donde ambos pa ses deber an seguir el Acuerdo de Preferencias Comerciales (PTA) Indonesia-SACU, ya que ambas partes estar an en mejor situaci n basada en los beneficios econ micos potenciales predichos. Adem s del comercio, promover la inversi n extranjera directa de Indonesia y la cooperaci n t cnica son otra cooperaci n econ mica potencial de beneficio mutuo para ambos pa ses.

Palabras clave || Ventaja comparativa, Competitividad de productos, Acuerdo de preferencias comerciales, Diplomacia econ mica, An lisis de pol tica exterior

1. Introduction

In 1991, Indonesia and Namibia established diplomatic relations, with the Joint Communique signed by both nations in New York. Over time, the diplomatic ties between Indonesia and Namibia have grown stronger, based on shared interests, mutual respect, and interpersonal connections, resulting in a recognised partnership and friendship. Prior to Namibia s independence, Indonesia provided support throughout the country s liberation struggle and independence process. Indonesia collaborated with the South West Africa People s Organisation (SWAPO) in the United Nations forum during Namibia s struggle for independence and played an active role as a member of the Namibian Council and Decolonization Committee (Adnan, 2008).

Indonesia regards Namibia as a friendly, democratic, and peaceful country that is open to and appreciative of foreign cultures, particularly in the political arena. Mutual visits by their leaders have exemplified the cordial relationship between the two nations. To date, the Namibian Government has consistently shown its support for the Unitary State of the Republic of Indonesia. Namibia s foreign policy principles, as stated in Article 96 of its Constitution, are based on non-alignment and the promotion of mutually beneficial good relations with other nations, as well as the peaceful settlement of international disputes to foster peace and security (Mushelenga, 2014).

In 1997, a Framework Agreement on Economic, Scientific, Technical, and Cultural Cooperation was signed by Indonesia and Namibia, and they exchanged notes to establish a Joint Commission. Subsequently, in May 2009, a Memorandum of Understanding was signed by the governments of the two countries to establish a Joint Commission for Bilateral Cooperation. The first session of the Joint Commission for Bilateral Cooperation was held in Jakarta on May 11-12, 2009, during which the two countries agreed on 19 areas of cooperation and signed several agreements (Embassy of the Republic of Indonesia in Windhoek, 2015).

The meeting marks a significant moment in the bilateral relations between the two countries, highlighting their commitment to strengthening friendship and cooperation. In addition, during President Geingob s state visit to Indonesia from 29 August to 1 September 2018, the two nations signed a Memorandum of Understanding (MoU) on Marine Affairs and Fisheries Cooperation (signed on 30 August 2018 in Bogor), as well as an MoU between their Chambers of Commerce and Industry. The increased focus on economic cooperation, including trade, investment, tourism, agriculture, and technical cooperation, underscores the countries growing economic ties. Namibia is considered a non-traditional market for Indonesia s economic diplomacy mission and is highly regarded as one of Indonesia s friendly nations (Sjahril, 2021).

The two countries bilateral trade volume increased from $2.28 million in 2000 to $8.4 million in 2022, according to United Nations Commodity Trade Statistics Database or UNCOMTRADE (2023). Indonesia exports primarily fish (preparation and frozen fish), footwear, food products, furniture, tyres, soap, yarn, textiles, hand tractors, and coconut milk. Meanwhile, Namibia exports unwrought zinc, dates, frozen crustaceans, and dairy products to Indonesia. In terms of investment, there were five Namibian investment projects in Indonesia between 2010 and 2020, with a total value of US$2,119,400, according to the Indonesia Investment Coordinating Board (2021). In the tourism sector, the number of Namibian tourists visiting Indonesia increased from 110 in 2010 to 588 in 2019 but declined to 116 in 2020 due to the COVID-19 pandemic (Embassy of the Republic of Indonesia in Windhoek, 2021).

Indonesian President Joko Widodo (Jokowi) has stated that economic diplomacy will be his top priority during his presidency. Economic diplomacy is one of Indonesia s foreign policy priorities in 2019-2024, which rests on the 4+1 Formula[1]. Indonesian economic diplomacy focuses on the integrated promotion of trade and investment and encouraging outbound investment (Kemlu, 2019). Furthermore, the current Indonesian economic diplomacy direction, among others, emphasises the enhancement and further breakthroughs in non-traditional and traditional markets. Africa is one of the non-traditional markets identified by Indonesia. As a result, this paper, which attempts to discuss ways to strengthen bilateral economic relations between Indonesia and Namibia, is potentially viewed to be strategic.

Namibia, a relatively new nation in Africa, holds great potential for economic growth and has certain economic potentialities to offer. In 2022, Namibia posted Gross Domestic Product (GDP) growth rate of 7.6%. According to the World Bank, Namibia is an upper-middle-income country and ranks third in the Southern African region behind Botswana and South Africa, surpassing Eswatini and Lesotho. Namibia s economy is heavily reliant on trade and is relatively open. The country s Vision 2030 aims to transform Namibia into a prosperous and competitive nation with an industrialised economy that can compete globally. There have been relatively few studies on the economic relations between Indonesia and Southern African nations, particularly Namibia. This paper aims to explore opportunities and propose ways to advance the current Indonesia-Namibia bilateral economic relations.

2. Research Methodology

This study aims to investigate ways to improve Indonesia-Namibia bilateral economic relations, guided by four main objectives: 1) to identify and analyse their respective foreign policies (particularly in terms of their economic diplomacy mission); 2) to identify and analyse Indonesian and Namibian export competitiveness; 3) to explore Indonesia-Namibia free trade cooperation via establishing Indonesia-Southern African Customs Union (SACU) Preferential Trade Agreement (PTA); 4) to conduct future scenarios and trends analysis, and 5) to provide economic diplomacy recommendations on what Indonesia and Namibia can do to improve their bilateral relations.

Economic diplomacy, comparative advantage, and Preferential Trade Agreement (PTA) are the main terms and concepts used to describe the subject of this study. First, economic diplomacy refers to the use of a state s economic tools to achieve its national interests, involving decision-making and negotiation processes related to international economic relations (Bayne & Woolcock, 2011). Its scope encompasses a range of activities, including policy decisions aimed at influencing exports, imports, investments, lending, aid, and free trade agreements. The purpose of economic diplomacy is to enhance a country s economic competitiveness and stimulate growth, as well as improve its relations with other countries.

Next is the comparative advantage theory, in which David Ricardo (1817) introduced and suggested that countries can gain a trade advantage by focusing on producing goods that have the lowest opportunity costs compared to other nations (Salvatore, 2014). According to Ricardo, the principle of comparative advantage is based on allowing economies to specialise, which results in gains from trade. This study uses the comparative advantage concept to examine the export competitiveness of Indonesia and Namibia. To achieve this, product mapping analysis with Revealed Symmetric Comparative Advantage (RSCA) and Trade Balance Index (TBI) have been employed as analytical tools. This analytical tool among others are utilized by Tri Widodo in his scholarly paper (Tri Widodo, 2010). The analysis of each country s export competitiveness is based on the use of two analytical tools, RSCA and TBI, using trade data from the year 2020.

The following term is the Preferential Trade Agreement (PTA) which is a type of trade agreement that gives preferential treatment to certain goods and services traded between two or more countries. This preferential treatment can include tariff reductions, tariff eliminations, or other trade benefits and is designed to increase trade between the participating countries. According to Bhagwati (2008), PTAs are an essential tool for promoting trade liberalisation among countries. They can help to overcome political obstacles to free trade and provide a stepping stone towards broader multilateral agreements. PTAs have become increasingly popular in recent years, with many countries using them as a means of increasing their trade with other countries. Some examples of PTAs include the Indonesia-Mozambique PTA, Indonesia-Pakistan PTA, Preferential Tariff Arrangement-Group of Eight Developing Countries (PTA-D8), Namibia-Zimbabwe PTA and Southern African Customs Union-Southern Common Market PTA (SACU-MERCOSUR PTA).

For this study, a simulation of the potential economic impact of trade liberalisation between Indonesia and Namibia is used to evaluate the impact of free trade or trade liberalisation. The simulation utilizes the Software for Market Analysis and Restrictions on Trade (SMART) model, which is a partial equilibrium trade simulation tool. The study uses UNCOMTRADE trade data for the year 2020 and 3 digit Standard International Trade Classification (SITC) Revision 2 code. The study evaluates the potential economic impacts of Indonesia-Namibia trade liberalisation, assuming a scenario of full liberalisation or complete removal of tariffs (zero tariffs). Specifically, the study analyses the potential impacts on welfare, tariff income, and changes in imports and exports.

Last but not least, this study will also conduct future scenarios and trends analysis, followed by formulating economic diplomacy recommendations to enhance bilateral relations between the two countries.

3. Result and Discussion

3.1 Indonesia-Namibia Foreign Policy Analysis

The Namibian foreign policy legal frameworks and statutory provisions are based on the Namibian Constitution: Article 96 Foreign Relations and Article 144 International Law (Legal Assistance Centre, 2023). Namibia adopts and maintains a policy of non-alignment, non-interventionism and respect for state sovereignty, and President Hage Geingob (2016) once stated that in its foreign relations policy with an idiom: Namibia is a friend to all and an enemy to none . The Namibian government also has 2004 White Paper on Foreign Policy and Diplomacy Management and Namibia s Foreign Policy on International Relations and Cooperation Document (2017) which emphasise economic diplomacy to support national development, support for multilateralism, and regional coordination and building stronger ties with African states (commitment to Pan-Africanism). Further, the Namibian foreign policy is oriented to support the national development agenda based on the Harambee Prosperity Plans I and II.

Namibia s foreign policy, as outlined in the 2004 White Paper on Foreign Policy and Diplomacy Management, emphasises economic diplomacy as a central focus. The paper underscores the significance of economic diplomacy in advancing economic growth within Namibia, generating employment opportunities, and attracting foreign currency. Given the emerging economic order since independence, the Namibian government has pursued a neoliberal, externally oriented strategy to stimulate domestic economic progress. Integration of the national economy with the global economy is necessary, considering the country s limited domestic market.

According to the White Paper, Namibia s diplomats and foreign missions are urged to play an active role in promoting the country as a desirable trade partner, tourist destination, and investment location while also gathering economic intelligence and exploring potential business opportunities that could prove beneficial to the nation. The paper emphasises that Namibia has adopted an externally oriented approach to stimulate economic growth and development, with export-oriented policies being a critical component. The expansion of the country s economy hinges on exports, particularly of non-traditional, manufactured goods.

Meanwhile, Indonesian President Joko Widodo (Jokowi), in his second administration from 2019-2024, has once again prioritised economic diplomacy, with 80-90% of official representatives tasks focused on economic and commercial cooperation (Rachma, 2014). Indonesia is actively seeking to enhance economic cooperation with numerous countries worldwide, with over 40 initiatives under study, negotiation, or implementation as of May 2023 (Asia Regional Integration Center, 2023). The current economic diplomacy strategy includes expanding established businesses and exploring new opportunities in non-traditional markets, such as Africa.

The Indonesian government endorsed the Indonesia-SACU PTA as an economic diplomacy policy in 2017, and the latest in response to this proposal, Thabo David Khasipe, Executive Secretary SACU Secretariat (2023), informed that strengthening trade relations and discussion for a possible PTA with Indonesia is an area the SACU Member States would be interested to explore. However, the SACU Council of Ministers has put in place a Moratorium on new Trade Negotiations with third parties at present due to a full trade negotiating schedule in which SACU is involved, including the African Continental Free Trade Area (AfCFTA).

One possible approach to enhancing trade relations between Indonesia, Namibia, and other southern African nations, including South Africa, Botswana, Eswatini, and Lesotho, is to establish a free trade agreement under the Indonesia-SACU PTA scheme. Such a policy aligns with the goal of creating equitable, mutually advantageous relations between the countries. Moreover, beyond its economic benefits, free trade is viewed as a means of fostering amicable ties between all parties involved.

As a member of the World Trade Organization (WTO), Namibia has entered into a broad range of trade agreements with both regional African economic blocs and global trading partners. These include the Africa Growth and Opportunity Act (AGOA) with the United States (which provides trade preferences for Namibia until 2025), the Cotonou Agreement between the European Union (EU) and the African, Caribbean, and Pacific Group of States (ACP), the Generalised System of Preferences (GSP), the Namibia-Zimbabwe Preferential Trade Agreement (PTA) of 1992, SACU, the SACU-European Free Trade Association (EFTA) FTA of 2008, the SACU-Southern Common Market (MERCOSUR) PTA of 2016, the SACU-USA Trade, Investment, and Development Cooperation Agreement/TIDCA of 2008, the SADC FTA of 2008, the Southern African Development Community (SADC) Protocol on Trade of 1999, and the SADC-European Union (EU) Economic Partnership Agreement (EPA), which provides full customs-free access to the EU market.

It is evident from their foreign policy agendas that strengthening economic relations through economic diplomacy is a key priority for Indonesia and Namibia. Despite having signed various economic agreements over the years to strengthen their bilateral economic ties, these relations have yet to reach their full potential, as evidenced by the Trade, Tourism, and Investment (TTI) data since the establishment of diplomatic relations. Increasing trade and investment, and creating opportunities for shared prosperity in the future would be mutually beneficial. The current state of bilateral economic relations does not fully reflect their potential, and both countries need to explore additional avenues to elevate their bilateral relations to a higher level.

3.2 Product Competitiveness Mapping Analysis: Indonesia vs Namibia

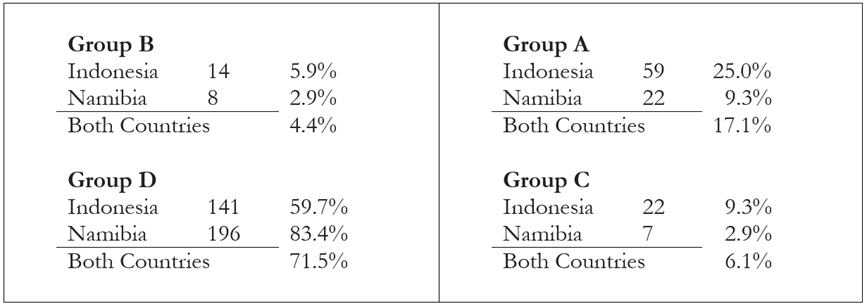

The analysis of the product competitiveness maps for each country reveals that Indonesia has a higher number of export products with high competitiveness compared to Namibia. Specifically, Indonesia has 59 high-competitive export products (Group A) for which it is a net exporter, while Namibia has only 22. However, it is also evident that neither country has been successful in significantly improving the competitiveness of its export products. For instance, 59.7% of Indonesia s total export products belong to Group D, indicating low competitiveness and net import status. Similarly, about 83.4% of Namibia s total export products are in Group D. Therefore, although Indonesia has more high-competitive export products than Namibia, both countries still have low export product competitiveness.

Table 1: Product Mapping Analysis, Indonesia vs Namibia Year 2020. Source: Author s Computation from World Integrated Trade Solutions (2023)

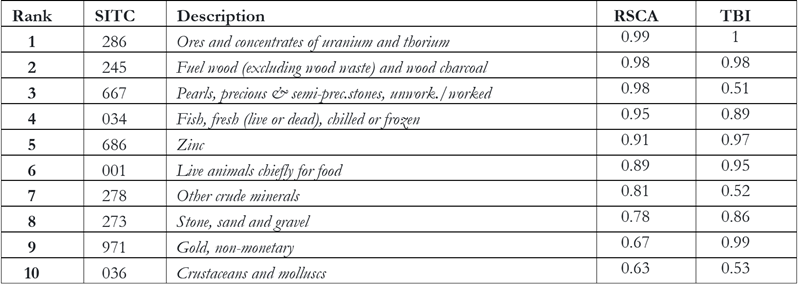

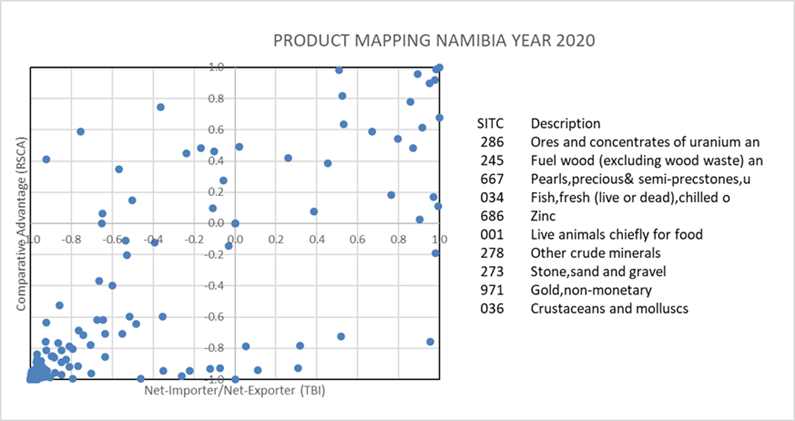

Namibia s product competitiveness mapping indicates that the country has relatively few export products in Group A, with only 22 products accounting for 9.3% of all Namibian export products. Namibia s export products are primarily low in competitiveness, representing 83.4% of all exports and placing them in Group D, which makes Namibia a net importer. Namibia relies heavily on imports, mainly from South Africa, its main trading partner, due to limited local industries, insufficient domestic resources, and low product competitiveness. Namibia s export products appear to be concentrated in raw mining products such as uranium, diamonds, gemstones, zinc, copper, gold, and tin (lead), as well as selected fisheries and livestock products (specifically beef), indicating a lack of export product diversification. Namibia has a number of highly competitive export products, which are ranked highest in TBI. These products include ores and concentrates of uranium and thorium (SITC 286), fuel wood (excluding wood waste) and wood charcoal (SITC 245), pearls, precious and semi-precious stones, unworked or worked (SITC 667), fish (fresh, live, dead, chilled, or frozen) (SITC 034), zinc (SITC 686), and live animals, mainly for food (SITC 001). All of these products fall under group A of the product mapping, which identifies highly competitive products. For many years, Namibia has relied heavily on natural resources such as minerals, fisheries, and livestock.

Table 2: The RSCA and TBI Results for Namibia Year 2020 (Group A Top 10). Source: Author s Computation from World Integrated Trade Solutions (2023)

Graph 1: Product Mapping Analysis for the Republic of Namibia Year 2020. Source: Author s Computation from World Integrated Trade Solutions (2023).

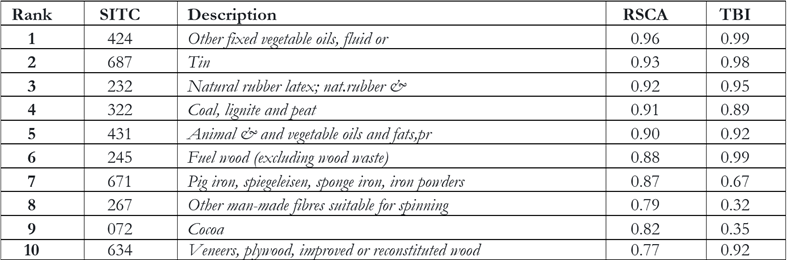

The competitiveness mapping of Indonesian products indicates that there are only 59 products classified in group A, which is relatively few. Furthermore, approximately 59.7% of Indonesia s total export products (141 export products) fall into group D, which indicates low competitiveness, making Indonesia a net importer. This suggests that the Indonesian government has been unsuccessful in diversifying its export products over time. Due to limited local supply and the government s import-friendly policies, Indonesia continues to rely on imported products to meet domestic demand heavily.

Table 3: The RSCA and TBI Results for Indonesia Year 2020 (Group A Top 10). Source: Author s Computation from World Integrated Trade Solutions (2023)

Indonesia has 59 highly competitive export products that have the highest TBI, with vegetable oil (SITC 424), tin (SITC 687), natural rubber (SITC 232), coal (SITC 322), animal and vegetable oils and fats (SITC 431), fuel wood (excluding wood waste) (SITC 245), iron (SITC 671), other manufactured fibres (SITC 267), cocoa (SITC 072), and veneers, plywood, improved or reconstituted wood (SITC 634) being the top 10.

The main products exported by Indonesia in 2020 were palm oil (SITC 424), with a value of US$19.3 billion; coal (SITC 322), with a value of US$16.4 billion; non-monetary gold (excluding gold ores and concentrates) (SITC 971), with a value of US$5.6 billion; natural and manufactured gas (SITC 341), with a value of US$5.3 billion; pig iron, spiegeleisen, sponge iron, iron powders (SITC 671), with a value of US$4.9 billion, and; footwear (SITC 851), with a value of US$4.7 billion. These figures indicate that Indonesia s exports are still heavily dependent on the mining, oil, and gas sectors, although the government has made efforts to diversify exports by promoting agriculture and manufacturing.

Graph 2: Product Mapping Analysis for the Republic of Indonesia Year 2020. Source: Author s Computation from World Integrated Trade Solutions (2023)

3.3 Indonesia-Namibia Preferential Trade Agreement: A Trade Simulation

3.3.1Impact on Indonesia-Namibia Change in Exports and Imports

According to the study, if Indonesia and Namibia were to engage in bilateral trade liberalisation, it would result in a US$426294 increase in Indonesian exports to Namibia. The top five Indonesian export products that would see the largest increase in export volume to Namibia are: footwear (SITC 851) valued at US$45874; civil engineering and contractor s plant and equipment and parts thereof, n.e.s (SITC 723) valued at US$40259; trunks, suitcases, vanity cases, executive cases, briefcases, etc (SITC 831) valued at US$38503; parts and accessories of motor vehicles (SITC 784) valued at US$36316; and furniture and parts thereof (SITC 821) valued at US$30016.

The simulation study also indicated that the liberalisation of bilateral trade would cause Indonesia to import more products from Namibia as the prices of imported goods decrease. This increase in imports represents the trade creation effect and illustrates the extent to which trade creation would affect imports. According to the study, the liberalisation of trade between Indonesia and Namibia would result in an increase of US$199,060 in the volume of Indonesian imports from Namibia. The following are the top 5 Indonesian import products that would experience the most significant increase in import volume from Namibia due to bilateral trade liberalisation: crustaceans and mollusks (fresh, frozen, or dried) including those in the shell and those boiled in water (SITC 036), valued at US$152,950; other fixed vegetable oils in fluid or solid form, whether crude, refined, or purified (SITC 424), worth US$22,019; fresh or dried fruits and nuts (excluding oil nuts) (SITC 57), valued at US$16,312; polymerisation and copolymerisation products (SITC 583), amounting to US$2,408; and, woven textile fabrics, excluding those made of cotton or synthetic fibers (SITC 654), worth US$2,150.

3.3.2 Impact on Tariff Revenues

The study anticipated that removing or reducing import tariffs on Namibian products would lead to a decrease in the revenue earned by the Indonesian government. The revenue loss that results from this change is referred to as the import tariff revenue. Under the scenario of full liberalisation between Indonesia and Namibia, the study projected that Indonesia s total tariff revenue would decrease by US$94637. The largest declines in Indonesian tariff revenue would come from the following products: crustaceans and molluscs, whether in shell or not, fresh (live or dead), chilled, frozen, salted, in brine or dried; crustaceans, in shell, boiled in water (SITC 036) which amounted to -US$80381; fruit and nuts (not including oil nuts), fresh or dried (SITC 57) which amounted to -US$7469; other fixed vegetable oils, fluid or solid, crude, refined or purified (SITC 424) which amounted to -US$4490; and polymerisation and copolymerisation products (SITC 583) which amounted to -US$1096. These four products would account for 98.73% of Indonesia s total tariff revenue loss in 2020.

Meanwhile, for Namibia, according to the model, trade liberalisation between Indonesia and Namibia is expected to decrease Namibia s tariff revenue by US$210,009. The largest losses in tariff revenue for Namibia would be from footwear (SITC 851) with a value of -US$26,809, followed by men s or boys coats, capes, jackets, suits, blazers, etc., and similar articles of textile fabrics, knitted or crocheted (SITC 843) worth -US$20,558; civil engineering and contractor s plant and equipment and parts thereof, n.e.s (SITC 723) valued at -US$20,150; rubber tyres (SITC 625) costing -US$17,764; and parts and accessories of motor vehicles (SITC 784) worth -US$16,912. These five products would represent 48.66% of Namibia s total tariff revenue loss in 2020.

3.3.3. Impact of Changes on the Welfare of Indonesian and Namibian Societies (Consumer Surplus / Consumer Welfare)

To measure welfare, one can consider the changes in consumer surplus. Based on the model, the liberalisation of trade between Indonesia and Namibia is predicted to increase the welfare of Indonesian consumers by US$2715. This improvement is attributed to four main products: crustaceans and molluscs, whether in a shell or not, fresh (live or dead), chilled, frozen, salted, in brine or dried; crustaceans, in shell, boiled in water (SITC 036) valued at US$2021; fruit and nuts (not including oil nuts), fresh or dried (SITC 57) worth US$311; other fixed vegetable oils, fluid or solid, crude, refined or purified (SITC 424) amounting to US$253; and textile fabrics, woven, other than of cotton or manufactured fibers (SITC 654) valued at US$91. These four products account for 98.56% of the total increase in welfare for Indonesian consumers.

The study also predicts that trade liberalisation between Indonesia and Namibia will increase the welfare of Namibian consumers by US$10838. The products that are expected to bring the largest increase in consumer surplus are trunks, suitcases, vanity cases, executive cases, briefcases, etc. (SITC 831) with a value of US$2334; men s or boys coats, capes, jackets, suits, blazers, etc. and similar articles of textile fabrics, knitted or crocheted (SITC 843) worth US$1648; and footwear (SITC 851) with a value of US$1227. Rubber tyres (SITC 625) are also expected to increase Namibian welfare by US$1193; and men s or boys coats, capes, jackets, suits, blazers, etc. and similar articles of textile fabrics, knitted or crocheted (SITC 841) by US$893. These top five products are projected to contribute to 67.31% of the total increase in the welfare of Namibian consumers.

3.4 Future Scenarios and Trends Analysis

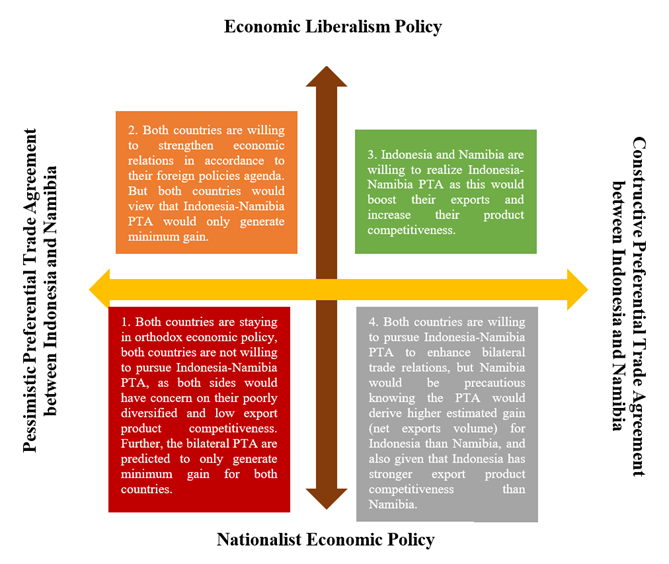

This section will proceed to look at future scenarios and trends. This paper uses scenario planning to predict the future in a structured manner to assist in developing policy recommendation options to respond to the issue highlighted in this paper. Based on the scenario planning approach, there are two critical uncertainties (variables), namely:

a. Economic Policy Paradigm (Liberalism vs Nationalist Economic Policy)

b. Strengthening Economic Cooperation through Indonesia-Namibia PTA (Constructive vs Pessimistic)

The economic policy paradigm shall be laid on the vertical axis, while the horizontal axis will denote the issue of strengthening economic cooperation through the Indonesia-Namibia PTA. The combination of the two aspects would be mapped into four scenarios (see graph 3). The scenario planning approach reveals four scenarios: first, both countries stay in orthodox economic policy, and they are not willing to pursue Indonesia-Namibia PTA, as both sides have concerns about their respective poorly diversified and low export product competitiveness. Further, the bilateral PTA is predicted to generate only a minimum gain for both countries. In the second scenario, both countries are willing to strengthen economic relations in accordance with their foreign policy agenda. But both countries would view Indonesia-Namibia PTA as only generating a minimum gain. In the third scenario, Indonesia and Namibia are willing to realise Indonesia-Namibia PTA as this would boost their exports and increase their product competitiveness. In the fourth scenario, both countries are eager to pursue Indonesia-Namibia PTA to enhance bilateral trade relations. However, Namibia would be precautious knowing the PTA would derive a higher estimated gain (net export volume) for Indonesia than Namibia, and also given that Indonesia has stronger export product competitiveness than Namibia.

The best scenario from this case is Scenario 3. In this scenario, if Indonesia and Namibia can establish a binding agreement to form PTA, both parties can be better off compared if both countries choose protection (conservative economic policy and pessimistic in engaging PTA). Using the SMART model analysis, the Indonesia-Namibia PTA would open market access by exporting their products to one another, ultimately enhancing bilateral trade relations. The Indonesia-Namibia PTA through the Indonesia-SACU PTA initiative is viewed to be one of the breakthroughs to boost bilateral trade relations and a win-win economic cooperation solution. Both countries also view that PTA would help enhance their export product competitiveness by specialising trade in goods based on their respective comparative advantage. But, this scenario should be supported with more diverse products for both countries. Both countries exports still have low competitiveness and are highly dependent on the primary sector, which is why product diversification is essential to enhance trade relations further. To address the economic diversification concern, Indonesia could explore an outbound investment in Namibia as another win-win economic cooperation for both countries.

Graph 3: Scenario Planning

Promoting Indonesian outbound investment is one of the priorities within the economic diplomacy agenda. To encourage outbound investment, for instance, the Ministry of Foreign Affairs of the Republic of Indonesia signed the MoU with the Ministry of State-Owned Enterprises on 17th July 2020 and with PT Pertamina on 21st January 2021 (Kemlu, 2021). The Ministry of Foreign Affairs stated that it will continue to encourage and facilitate Indonesia s outbound investment abroad to expand the Indonesian product market and enhance Indonesian industries competitiveness at the global level (Eldora & Tjahyoputra, 2020). Further, the Ministry of Foreign Affairs will ensure that bilateral investment treaties would guarantee fair treatment and the protection of Indonesian companies investing abroad. Therefore, in scenario 3, the promotion of integrated trade and investment and the encouragement of outbound investment are important economic diplomacy activities to be pursued to advance Indonesian national interest. Given the scenario planning analysis, the policy implications (policy choices) of the four scenarios mentioned previously are as follows:

Scenario I Change Mindset and Strengthen Economic Diversification

Both countries should change their mindsets towards economic liberalist views, in which economic cooperation should be fostered, and trade is viewed as a critical driver of economic growth and development, job creation, and can drive improvement in the competitiveness of local industries. Thus, pursuing Indonesia-Namibia PTA would not only open new and enhance market access for their exports but also enhance national economic growth and development. Further, knowing that both countries are still faced with the challenge of limited economic diversification and the majority of their export products are low competitiveness. Thus, both countries should make more efforts to promote economic diversification to increase competitiveness and economic growth, create employment opportunities, and ultimately enhance the country s participation in international trade cooperation.

Scenario II Search for Alternative Ways to Enhance Economic Cooperation

Both countries should view trade as a critical driver of economic growth and development and enhance the competitiveness of local industries. Thus, Indonesia-Namibia PTA should be pursued despite the predicted minimum benefits to be reaped. Further, as both countries prioritise economic diplomacy within their foreign policy agenda, both countries should search for alternative ways to strengthen economic cooperation. This includes promoting investment and technical cooperation between the two countries.

Scenario III Promote PTA and Outbound Investment

Both countries are willing to pursue Indonesia-Namibia PTA as this would enhance exports and increase product competitiveness by specialising in trade in goods based on their respective comparative advantage. The Indonesia-Namibia PTA through the Indonesia-SACU PTA initiative is viewed to be one of the breakthroughs in boosting bilateral trade relations and win-win economic cooperation. But, this scenario should be supported with more diverse products for both countries. Both countries exports still have low competitiveness and are highly dependent on the primary sector; thus, promoting export diversification is essential to enhance trade relations further. To address the economic diversification concern, Indonesia could explore an outbound investment in Namibia as another win-win economic cooperation for both countries. On the one hand, promoting Indonesian outbound investment is one of the priorities within the Indonesian economic diplomacy agenda. The Ministry of Foreign Affairs stated that they will continue to encourage and facilitate Indonesia s outbound investment abroad to expand the Indonesian product market and increase the competitiveness of Indonesian industries at the global level (Eldora & Tjahyoputra, 2020).

Further, the Ministry of Foreign Affairs will ensure that bilateral investment treaties guarantee fair treatment and protect Indonesian companies investing abroad. On the other hand, Namibia is in urgent need of developing its domestic industries to promote economic development and economic diversification. As discussed earlier, economic diplomacy is a dominant theme in Namibian foreign policy in the 2004 White Paper to promote economic development within Namibia. Thus, the intention of Indonesian outbound investment to Namibia would be very well-received. The Indonesian outbound investment in Namibia could catalyze economic diversification and help empower Namibia to develop new industries and expand its economic base as well as reduce Namibia s vulnerability to external shocks, foster sustainable economic growth and create job opportunities.

To start with the investment engagement, Indonesian outbound investment could be directed based on the Namibian economic diversification needs as clearly stated in the Catalogue of Projects and Potential Investment Opportunities in Namibia released by Namibia Investment Promotion and Development Board (NIPDB) in 2022. The catalogue highlights investment opportunities available in Namibia, both in the public and private sectors, including energy, agriculture, infrastructure, transport and logistics, water, housing and real estate, mining, and tourism. Also, the SACU Investment Projects Booklet released during the SACU Investment Roundtable in 2022 could be another guide to look for investment opportunities in Namibia (SACU Secretariat, 2022). Thus, under this scenario, the promotion of integrated trade and investment and encouraging outbound investment are important economic diplomacy activities to be pursued to advance both countries national interests.

Scenario IV Promote Technical and Investment Cooperation

Both countries are willing to establish an Indonesia-Namibia PTA to enhance bilateral trade relations. However, Namibia would be precautious knowing the PTA would derive higher estimated gain (net export volume) for Indonesia than Namibia, given that Indonesia has stronger export product competitiveness than Namibia. To respond to this concern, the Indonesian government should proactively pursue economic diplomacy to promote Indonesian outbound investment and technical cooperation in Namibia. As discussed earlier, Indonesia aims to promote outbound investment in Africa, including Namibia, as Indonesia wants to engage and become part of the successful stories in Africa s economic development, as stated by Foreign Minister Retno Marsudi (Kemlu, 2023). Further, Indonesia should also promote technical cooperation by providing capacity building (education and training) in accordance with Namibia s economic diversification needs. This technical cooperation would further enhance the Indonesian positive image in Namibia.

Conclusion and Recommendations

Over the years, the diplomatic relations between Indonesia and Namibia have been warm and strengthened over time. Both countries have established a recognised partnership and cordial political ties. But despite the cordial political relations, the economic relations are still below their full potential. The Trade, Tourism, and Investment (TTI) data have reflected far from their true potential. Thus, both countries need to identify ways to elevate bilateral relations to a higher level.

Based on their respective foreign policy agendas, the study reveals that both countries foreign policy agendas have common interests to strengthen friendly relations, including enhancing economic relations through economic diplomacy with the ultimate aim of promoting national economic development in their respective countries. Both countries view that it would be mutually beneficial to strengthen trade, investment, and create opportunities for shared prosperity in the future.

The analysis of product competitiveness mapping presented above suggests that there are opportunities to strengthen bilateral trade relations between the two countries, as their export product specialisations complement each other. However, the analysis also indicates that both countries have an undiversified economic structure and are net importers, relying heavily on imported products to meet domestic demand. Therefore, further diversification of the economic structure and the export products could potentially be mutually beneficial, as it could enhance bilateral trade relations by offering a wider range of product options to be exchanged between the two countries.

Meanwhile, the partial equilibrium free trade simulation employed shows that both countries would potentially benefit from bilateral FTA arrangements. The simulation reveals higher trade volumes and consumer surpluses (society s welfare), which would offset predicted tariff revenue loss. The study recommends pursuing bilateral free trade cooperation between Indonesia and Namibia by establishing the Indonesia-SACU PTA to improve bilateral trade relations.

Based on the future scenario planning and trends, given the two critical uncertainties (variables) economic policy paradigm and strengthening economic cooperation through Indonesia-Namibia PTA, the best scenario from the case is Scenario 3. Within this scenario, if Indonesia and Namibia can establish a binding agreement to form PTA, both parties can be better off compared if both countries choose protection (conservative economic policy and pessimism in engaging PTA). The Indonesia-Namibia PTA would open market access by exporting their products to one another, ultimately enhancing bilateral trade relations. Thus, the Indonesia-Namibia PTA through the Indonesia-SACU PTA initiative is viewed to be one of the breakthroughs to boost bilateral trade relations and a win-win economic cooperation solution. Both countries also view that PTA would help enhance their export product competitiveness by specialising trade in goods based on their respective comparative advantage.

But, this scenario should be supported with more diverse products for both countries. Both countries exports still have low competitiveness and are highly dependent on the primary sector, which is why product diversification is important to enhance trade relations further. To address the economic diversification concern, Indonesia could explore an outbound investment in Namibia as another win-win economic cooperation for both countries. The Indonesian diplomats, as the spearhead of economic diplomacy, can facilitate the BUMN Go Global program in which the Indonesian SOEs expand their business overseas by maximising the given Indonesian political capital.

Also, the study takes note of the importance of promoting Indonesian technical cooperation in Namibia, particularly in the sectors in which Namibia s economic diversification is needed. This technical cooperation would not only mitigate the Namibia s precautiousness on the predicted PTA but would derive higher estimated gain (net exports volume) for Indonesia than Namibia, but simultaneously would further enhance the Indonesian positive image in Namibia.

References

Adnan, A. H. (2008). Perkembangan Hubungan Internasional di Afrika. Angkasa.

Asia Regional Integration Center (2023). Free Trade Agreements. Asian Development Website. https://aric.adb.org/fta-country

Bayne, N. & Woolcock, S. (2011). What is economic diplomacy? In N. Bayne & S. Woolcock (eds.), The New Economic Diplomacy: Decision-Making and Negotiation in International Economic Relations (pp. 1-16). Ashgate Publishing Ltd.

Bhagwati, J. (2008). Termites in the Trading System: How Preferential Agreements Undermine Free Trade. Oxford University Press.

B sl, A., du Pisani, A. & Zaire, D. U. (2014). Namibia s Foreign Relations: Historical Contexts, Current Dimensions, and Perspectives for the 21st Century. Macmillan Education.

Eldora, G. & Tjahyoputra, L. (9 January, 2020). Indonesia Perkuat Diplomasi Ekonomi. Investor. https://investor.id/international/202652/indonesia-perkuat-diplomasi-ekonomi

Embassy of the Republic of Indonesia in Windhoek (2015). Rencana Strategis (Renstra) 2015-2019 KBRI Windhoek. KBRI.

Embassy of the Republic of Indonesia in Windhoek (2021). Laporan Tahunan 2020 (Annual Report 2020). KBRI.

Indonesian Investment Coordinating Board (2021). Perkembangan Realisasi Investasi PMA Berdasarkan Negara Tahun 1990 s/d 2021. National Single Window for Investment, 2021. https://nswi.bkpm.go.id/data_statistik

Kemlu (2019). Pidato Menteri Luar Negeri: Penyampaian Prioritas Politik Luar Negeri Republik Indonesia 2019-2024. https://kemlu.go.id/portal/id/read/725/pidato/penyampaian-prioritas-politik-luar-%20negeri-republik-indonesia-2019-2024

Kemlu (2021). Kementerian Luar Negeri dan Pertamina Tandatangani Kerjasama Untuk Ekspansi ke Pasar Internasional. https://kemlu.go.id/portal/id/read/2111/berita/kementerian-luar-negeri-dan-pertamina-%20tandatangani-kerjasama-untuk-ekspansi-ke-pasar-internasional

Kemlu (2023). Menlu Retno : Indonesia Ingin Menjadi Bagian dari Kisah Sukses Pembangunan Ekonomi Afrika. https://kemlu.go.id/portal/id/read/4380/berita/menlu-retno-indonesia-ingin-menjadi-bagian-dari-kisah-sukses-pembangunan-ekonomi-afrika

Legal Assistance Centre (2023). Namibian Constitution. Legal Assistance Centre Website. https://www.lac.org.na/laws/annoSTAT/Namibian%20Constitution.pdf

Ministry of International Relations & Cooperation (2017). Namibia s Foreign Policy on International Relations and Cooperation Document. MIRCO. https://mirco.gov.na/documents/140810/158796/Namibia%27s+Policy+on+International+Relations+and+Cooperation/9caa7be8-9ba2-4277-b9d5-3cabdcaedb10

Mushelenga, S. A. P. (2014). Principles and Principals of Namibia s Foreign Relations. In A. B sl, A. du Pisani, & D. U. Zaire (eds.), Namibia s Foreign Relations: Historical Contexts, Current Dimensions, and Perspectives for the 21st Century (pp. 59-80). Macmillan Education Namibia.

Namibia Investment Promotion and Development Board (2022). Catalogue of Projects and Potential Investment Opportunities in Namibia.

Rachma, H. S. (2014). Jokowi Minta Duta Besar Lakukan Diplomasi Ekonomi dan Dagang. Merdeka. https://www.merdeka.com/uang/jokowi-minta-duta-besar-lakukan-diplomasi-ekonomi-dan-dagang.html

Republic of Namibia (2004). White Paper on Namibia s Foreign Policy and Diplomacy Management. Ministry of Foreign Affairs.

SACU Secretariat (2022). SACU Investment Roundtable: Positioning SACU as an Industrial, Investment, Manufacturing and Innovation Hub for the African Continent and Beyond A Compilation of Investment Projects in the SACU Region. SACU Secretariat. https://www.sacu.int/docs/roundtable/Final-SACU-Investment-Projects-booklet.pdf

Salvatore, D. (2014). International Economics: Trade and Finance. John Wiley & Sons.

Sjahril, S. (2021). Desain Klasterisasi Tujuan Pasar Ekspor Indonesia: Pasar Tradisional vs Pasar Non-Tradisional. Jurnal Hubungan Luar Negeri, January-June Edition. https://www.kemlu.go.id/portal/id/page/101/jurnal_hubungan_luar_negeri

United Nations COMTRADE (2023). International Trade Statistics. Un Comtrade Database. https://comtrade.un.org/data/

Widodo, T. (2010). Comparative Advantage: Theory, Empirical Measures and Case Studies. Review on Economic and Business Studies, 57-81. http://www.rebs.ro/articles/pdfs/21.pdf

World Integrated Trade Solution (2023). https://wits.worldbank.org/

Fecha de recepci n: 3 de marzo de 2024.

Fecha de aceptaci n: 3 de junio de 2024.